Editorial

Calendar arbitrage in the FX volatility surface

Today I would like to share an observation with you that my colleagues Alexander and Andreas discovered when analyzing FX volatility market data.

When we construct the FX volatility smile based on the usual FX brokers’ data ATM, 25-delta risk reversal (RR) and butterfly (BF), 10-delta risk reversal and butterfly, there is a decent fan club that uses an SVI (stochastic volatility inspired) parametric function for the total variance on the log-moneyness space.

We consider market data of 07 Jan 2014 for AUDJPY as follows:

| Tenor | 10 RR | 25 RR | ATM | 25 BF | 10 BF |

| 6M | -5.475 | -2.725 | 11.71 | 0.6 | 2.525 |

| 1Y | -7.1 | -3.525 | 12.44 | 0.65 | 2.975 |

| 2Y | -11.625 | -5.9 | 13.30 | 0.6 | 3.225 |

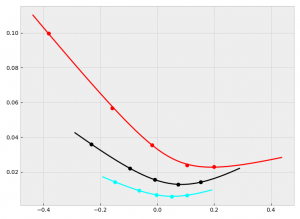

When we generate the volatility smile curves using an SVI parameterization we see the following variances on the log-moneyness space:

Calendar arbitrage occurs if the total variance, which is volatility squared times the time to maturity σ²T, for a given moneyness F/K and a longer maturity is smaller than the total variance for the same moneyness (and possibly a strike K adjusted by the ratio of forwards F of the two maturities respectively) and a shorter maturity. Such a scenario would yield negative forward variances. One can visualize calendar arbitrage by checking if the total variance curves intersect. If they do, then there is a (theoretical) calendar arbitrage opportunity. A real arbitrage opportunity would require including bid-offer spreads and a liquid market of very low delta-options.

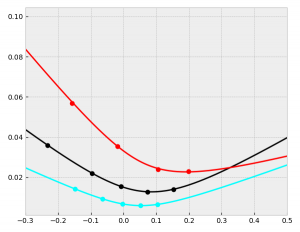

In the present scenario, we observe a rather good fit of the SVI-curves to the market volatility quotes. They are non-intersecting in the region of quoted volatilities. However, if we zoom out and plot the total variance curves on a wider log-moneyness range (x-axis), the curves for 2Y (red) and 1Y (black) intersect.

While the phenomenon is outside the usual range of traded options, it can still cause problems when using the volatility surface as a building block of an exotics model, such as a local volatility model. Note that this isn’t a market-based arbitrage, but a model-based arbitrage. It is the SVI parameterization that yields this effect.

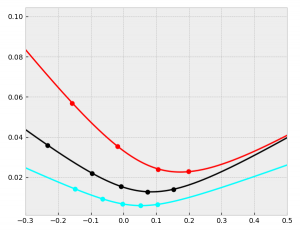

Solution: switch on the control-wings button in the MathFinance volatility surface MFVal. This ensures that calendar arbitrage is prevented in the SVI parameterization:

The 2Y curve (red) is now on top of the 1Y curve (black). This input for an exotics model is much more suitable.

Summary

Applying various interpolation techniques to construct the FX volatility surface from market quotations may introduce arbitrage. We showed a calendar arbitrage example with the popular SVI-parameterization and an idea how to fix it. Generally volatility surface construction requires detailed attention and permanent inspection.

Uwe Wystup, Managing Director of MathFinance

Upcoming Events

MATHFINANCE SEMINAR: FX EXOTIC OPTIONS

Date: November 27-29; 2017

Venue: Frankfurt School of Finance & Management, Adickesallee 32-34, 60322 Frankfurt am Main

Lecturer: Prof. Dr. Uwe Wystup

This advanced practical three-day course covers the pricing, hedging and application of FX exotics for use in trading, risk management, financial engineering and structured products.

FX exotics are becoming increasingly commonplace in today’s capital markets. The objective of this workshop is to develop a solid understanding of the current exotic currency derivatives used in international treasury management. This will give participants the mathematical and practical background necessary to deal with all the products on the market.

Learn more about the training or register directly.

EINLADUNG ZUM »SCIENCE IN FINANCE«- WORKSHOP

Wenn Sie sich fragen, wie die Bank Ihres Vertrauens die immer schneller werdende Abfolge von immer anspruchsvolleren regulatorischen Anforderungen durch mathematische Modellierung, neue Prozesse und Big Data in die Praxis umsetzt, dann nehmen Sie die Rolle derjenigen ein, die diesen regulatorischen Tsunami für die europäische Finanzindustrie in den letzten Jahren beherrschbar gemacht haben: Lernen Sie d-fine kennen – nicht als Bewerber, sondern als Berater! Erfahren Sie, wie Sie Ihren mathematischen Hintergrund und Ihre analytischen Fähigkeiten einbringen können, um die Stabilität der Finanzmärkte zu erhöhen. Als Berater in einem Projektteam von d-fine werden Sie für die d-fine Bank AG ein Modell entwickeln, um das Institut rechtzeitig in die Lage zu versetzen, die neuerlichen Bewertungsanforderungen der Aufsicht zu erfüllen – hierbei handelt es sich um eine Arbeit direkt aus der täglichen Praxis von d-fine. Erfahren Sie durch die Teamarbeit mit Ihren Kollegen/-innen und in der Interaktion mit den Abteilungen der Bank, wie herausfordernd und vielfältig die Arbeit eines d-fine Beraters ist!

d-fine ist ein führendes europäisches Beratungsunternehmen mit Standorten in Frankfurt, München, London, Zürich und Wien. Mit über 600 hochqualifizierten Beratern unterstützen wir unsere Kunden – Banken, Versicherungen und Industrieunternehmen – bei anspruchsvollen quantitativen, prozessualen und technologischen Herausforderungen. Strategieberatung, Fachberatung, Technologieberatung: d-fine ist alles in einem.

d-fine. Die Spezialisten für Risk&Finance

1. bis 3. November 2017 – Schlosshotel Kronberg im Taunus:

3-tägiger Workshop mit Vorträgen zur Finanzmathematik, einem Kundenprojekt unter Ihrer Beteiligung und Erfahrungsberichten aus unserer Consulting-Praxis. Bewerbungsschluss: 11. September 2017.

Kontakt:

d-fine GmbH

Svenja Dröll

An der Hauptwache 7

60313 Frankfurt am Main

T +49 69 907 37- 555,

Careers

MathFinance Openings

Senior Quant/ Consultant

We are looking for senior quant/ consultant in the areas of

Insurance

- Actuary with 5 to 7 years of experience in insurance or re-insurance

- Experience in quantitative Risk Management in relation to regulatory issues (Solvency II)

- Experience in Capital Management

Banking

- Quant with 5 to 7 years of experience in Banking, ideally in Trading

- Experience in quantitative Risk Management in relation to regulatory issues (Basel III)

- Experience in Capital Management

Investment

- Quant with 5 to 7 years of experience in Asset Management (Funds, Insurance and Family Offices), ideally with emphasis on Risk Management

- Experience in quantitative Risk Management in relation to regulatory issues (German KAGB and KARBV)

Please send us your CV to recruitments@mathfinance.com

Junior Quant

Do the following apply to you?

- Master degree or diploma in (business) mathematics or physics

- PhD or CFA is a bonus

- First experiences in mathematical finance is desirable

- Very good programming skills, e.g. C++, Python or Matlab

- Good language skills in German and English

- Outstanding analytical skills and a problem-solving attitude

- High motivation to develop your knowledge and skills

- Good communication skills and team spirit

Then we would like to hear from you. Please send us your CV to recruitments@mathfinance.com