Editorial

DCD in Ugandan Shilling

For exporters in Uganda there can be attractive short term investments in USD with a high coupon (in USD), since there are currency options trading in Uganda Shilling (UGX). The exporter receiving and hence selling USD for UGX, can lock in a conversion rate at current spot for two weeks, and receive 8.7% USD interest (p.a.).

Here is the example. We consider market data in USD-UGX of 28 June 2019: spot reference 3700, USD 2W deposit 2.368%, UGX 2W deposit 9.11%, ATM volatility 5.69%, RR 1.8%, BF 0.3%. See Figure1 for the last five years of history of spot.

Figure 1: historic spot Ugandan Shilling, sourced from Eikon

The exporting company can deposit 1 M USD for 2weeks and receives either 1M USD in 2 weeks or 3.7 B Shilling, whichever is weaker, plus an enhanced coupon of 8.71%, which is 6.344% above the USD funding rate. Since the treasurer needs to sell USD anyway, the guarantee (actually the obligation) to do this at the current spot rate doesn’t feel bad with an enhanced coupon like this. If the USD is weaker, i.e. if the spot in two weeks stays below 3700, then the treasurer can repeat this dual currency investment at similar conditions. Eventually, and the first time the Shilling is weaker, the USD will converted at initial spot.

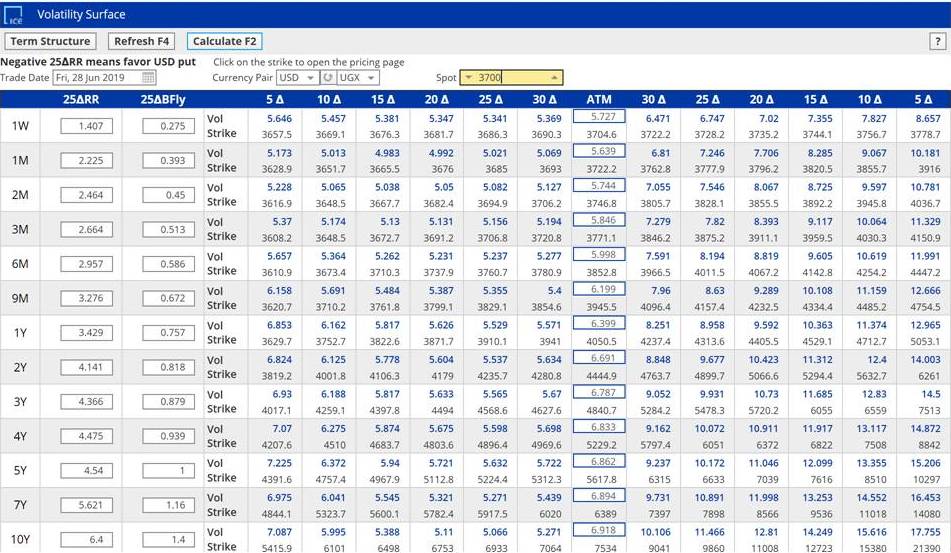

The sell-side benefit is a sales margin of 500 USD for each 2-week DCD of this kind, plus a bid-mid spread for the options trading desk. There is no credit risk for the sell-side. The only hurdle could be a missing risk management system for FX options and deposits linked to this. Interestingly, SuperDerivatives shows a full volatility surface (Figure 2).

Figure 2: USD/UGX volatility surface on 28 June 2019 source from SuperDerivatives

Even more visionary, the exporter could protect its USD sale in 6 months by a shark forward, with guaranteed worst case of 3800, 60 Shilling lower and worse than the forward, participate in a rising USD upto a level of 3900, after which the contract becomes a forward at 3800, still 100 pips better than the current spot. This would require a market for RKO barrier options in Uganda.

But apparently the market for currency options in Uganda is growing, so opportunities for currency risk management solutions are at our doorstep. Remarkably, USD/UGX volatilities are almost at the same level as EUR/USD. Food for thought.

Uwe Wystup

Managing Director of MathFinance

Upcoming Events

FX Exotic Options in Frankfurt 2019

September 18 – 20, 2019

Lecturer: Prof. Dr. Uwe Wystup

This advanced practical three-day course covers the pricing, hedging and application of FX exotics for use in trading, risk management, financial engineering and structured products.

FX exotics are becoming increasingly commonplace in today’s capital markets. The objective of this workshop is to develop a solid understanding of the current exotic currency derivatives used in international treasury management. This will give participants the mathematical and practical background necessary to deal with all the products on the market.

Check the details